by Filippo Maria D’Arcangelo, Tobias Kruse, Mauro Pisu and Marco Tomasi

Limiting global warming and the economic and social losses it will cause requires a drastic increase in investments in low-carbon infrastructures and technologies. Global annual investments in low-carbon energy alone will have to increase threefold by 2030 compared with the level in 2022 (IEA, 2022). Private capital plays a pivotal role in financing these investments. However, investors responsible for capital allocation decisions need clear policy signals and the capacity to correctly assess firms’ exposure to the risks and opportunities mitigation policies entail (i.e. transition risks). For example, mitigation policies might drive technological changes, accelerate the obsolescence of certain assets and cause changes in demand, which affect firms differently based on their environmental and economic performance.

A new OECD working paper (D’Arcangelo et al., 2023) assesses to what extent climate policies lead sophisticated investors (i.e. lenders in the syndicated loan market) to discriminate across borrowers’ environmental performance and how this affects borrowers’ investment decisions. The study investigates how changes in the stringency of mitigation policies impacts the syndicated loans’ spread (i.e. the interest rate of syndicated loans minus a benchmark interest rate) of borrowers with good and bad environmental performance – measured by firms’ emission intensities, patents in climate-change mitigation technologies, and Environment, Social and Governance (i.e. ESG) scores.

Stringent climate mitigation policies decrease the cost of debt of ‘green’ firms and increase that of ‘brown’ firms

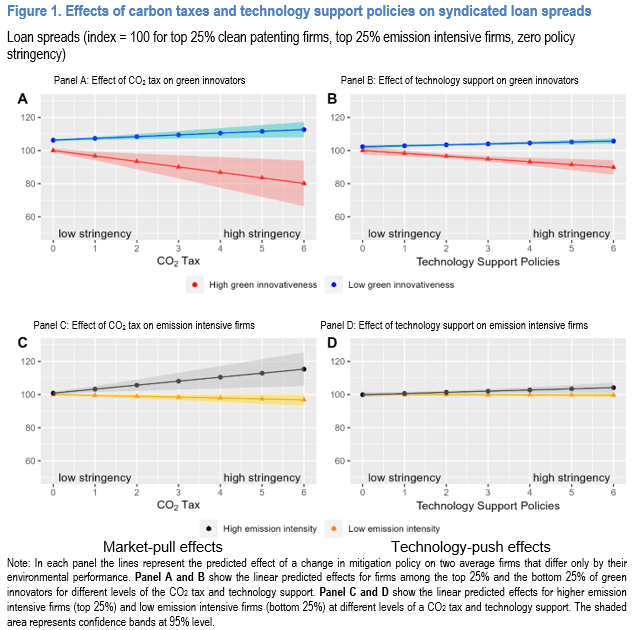

Firms with good environmental performance (measured by low emission intensity or high patenting activity in climate change mitigation technologies) benefit from a lower cost of debt, as measured by syndicated loans spread. These effects can be large when mitigation polices are stringent but disappears when they are not (Figure 1). For example, when carbon prices are above EUR 50/t CO2, firms in the top 25% of mitigation-technology patent’s distribution enjoy a loan spread that is 30% lower than firms in the bottom 25%. This is equivalent to EUR 1.5 million less in yearly interest payments for the median syndicated loan deal (or 41 basis points lower loan spread).

ESG scores are weak proxies of firms’ actual environmental performance and their exposure to transition risks

Sophisticated investors reward firms with good ESG scores irrespective of mitigation policies’ stringency, though they do not appear to rely on ESG scores to price transition risks. Firms disclosing an ESG score benefit from lower syndicated loan spreads and this advantage increases with better scores. However, the effect of ESG scores on loan spreads is disconnected from the stringency of climate policy. This finding supports the view that ESG scores are weak proxies of firms’ actual environmental performance (Berg, Kölbel and Rigobon, 2022; OECD, 2022a).

Pricing transition risks result in higher investments by ‘green’ firms and lower investment by ‘brown’ firms

Mitigation policies might encourage or discourage investment through the cost of debt. Simulations based on the empirical estimates indicate that a EUR 10/tCO2 increase in CO2 taxes (equivalent to the average increase between 2002 and 2018 for countries that have a CO2 tax) raises investment by 12% for the top green innovators. It decreases investment by 11% for the top emitters. These effects are also economically significant for technology-push policies. Increasing technology support policy (in line with what observed in the 2002-18 period) is associated with a 5.2% increase in investment for the top green innovators and a 2.7% decline in investment for the top emitters.

Aligning private capital with the net-zero transition needs better and more widespread data on firms’ environmental performance

The results suggest that investors operating in the syndicated loan market assess transition risks based on mitigation policies’ stringency and firms’ actual environmental performances. However, assessing and pricing firms’ transition risks may require detailed firm-specific information and the capacity to analyse them that only large and sophisticated investors (as those considered in this analysis) can afford. Relying on ESG and the Environmental pillar scores is not a viable substitute, as such scores do not provide yet sufficient information to assess firms’ transition risks.

Improving the quality of ESG scores is especially important for less sophisticated and passive investors, which tend to rely on such metrics to gauge transition risks and make investment decisions accordingly. Making strides in this direction, which include among other things improving the quality of corporate transition plans and establishing mandatory emission reporting (OECD, 2022b; OECD, 2022a), will mobilise larger private capital flows towards firms able to thrive as mitigation policies become more stringent and thus align capital allocation decisions with the net-zero transition.

References

Berg, Florian, Julian Kölbel, and Roberto Rigobon. 2022. “Aggregate Confusion: The Divergence of ESG Ratings.” Review of Finance 26 (6): 1315-1344. doi:https://doi.org/10.1093/rof/rfac033.

D’Arcangelo, Filippo Maria, Tobias Kruse, Mauro Pisu, and Marco Tomasi. 2023. “Corporate cost of debt in the low-carbon transition: The effect of climate policies on firm financing and investment through the banking channel.” OECD Economics Department Working Papers 1761. doi:https://doi.org/10.1787/35a3fbb7-en.

IEA. 2022. “World Energy Investment 2022.” doi: https://www.iea.org/reports/world-energy-investment-2022.

OECD. 2022a. “ESG ratings and climate transition: An assessment of the alignment of E pillar.” doi:https://doi.org/10.1787/2fa21143-en.

OECD. 2022b. “Policy guidance on market practices to strengthen ESG investing and finance a climate transition.” doi:https://doi.org/10.1787/2c5b535c-en.